Contact: +91 99725 24322 |

Menu

Menu

Quick summary: The world faces a formidable challenge to limit temperatures below 1.5˚C. Many countries are looking into carbon markets as a transformation required to address climate crisis. Voluntary Carbon markets offer a way to offset the business carbon footprint to fight global warming. Blockchain technology can be a differentiator in the much-needed credible carbon credit market

According to the recent reports by IPCC, the GHG emissions are still rising across the major sectors globally. The world faces a formidable challenge to limit temperatures below 1.5˚C. The latest IPCC report finds countries falling way short with financial flows three to six tomes lower than levels needed by 2030.

Many countries are looking into carbon markets as a transformation required to address climate crisis. Voluntary Carbon markets offer a way to offset the business carbon footprint to fight global warming.

How do purchasing carbon credits reduce your carbon footprint?

How do we know that it helps the environment?

These questions need to be answered so that carbon offsetting can be taken up confidently to really make a difference to the world.

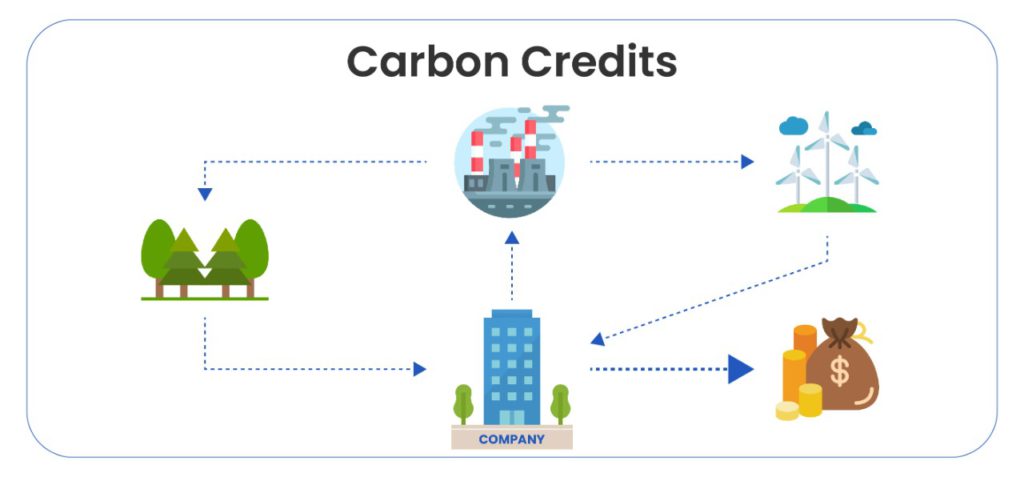

Carbon markets are trading systems in which carbon credits are sold and bought. One tradable carbon credit equals one tonne of carbon dioxide or equivalent amount of a different greenhouse gas reduced, sequestered or avoided.

These are created as a result of any national, regional or international policy or regulatory requirement. These are marketplaces through which regulated entities obtain and surrender emissions permits or offsets in order to meet the predetermined regulatory targets. In the cap-and-trade programs, there are emitters and intermediaries that trade allowances to make profit or to meet regulatory requirements. The active compliance carbon offset programs is the United Nations Clean Development Mechanism (CDM), source of offsets for Kyoto protocol Signatory countries.

The voluntary carbon market encompasses all transactions of carbon offsets that are purchased without the intention to surrender it into an active regulated carbon market. It includes offsets that are purchased with the intent to resell or retire to meet carbon neutral or other environmental claims. They are mainly driven by companies that take responsibility for offsetting their own emissions. The current supply of voluntary carbon credits comes from private entities which develop carbon projects, governments that develop programs certified by carbon standards which generate emission reductions or removals. The demand is usually from individuals who want to reduce their carbon footprint or corporates who want to achieve their sustainability targets and other players who want to trade these credits at a higher price to make profits.

The world needs to reduce emissions immediately to be on the Paris agreement track. The global emissions need to be cut by half by 2030 to reach the net-zero

target by 2050. It is reported that about 10Gt emission reductions can be delivered through nature- based solutions that aim to protect, restore and manage forests, soils and wetlands. The voluntary carbon market enables businesses, investors, governments, NGOs to voluntarily purchase verified emission reductions in the form of carbon credits. This serves as a tool to unlock the potential of nature-based solutions which is normally undervalued.

The Voluntary Carbon Market is essential for funding climate solutions

It requires that there is no contradiction between a business cutting its own emissions and using high quality credits to compensate for their residual emissions. Trust and integrity is very important in these markets. On the supply side, the carbon credits need to be of the highest quality in terms of accuracy, permeance, additional and benefit the biodiversity, while on the demand side greenwashing needs to be avoided by ensuring those credits do not allow companies from refraining to cut their own emissions.

A company cutting its own emissions in alignment with science based targets and the same company using high quality voluntary carbon credits to compensate for residual emissions has to be treated differently. The emission reductions in a company’s own supply chains is difficult and using voluntary carbon credits as a decarbonization strategy is essential to reach the net-zero target. The voluntary carbon market aims to mitigate climate change by allowing private players to finance the carbon projects.

According to McKinsey, the demand for carbon credits could grow upto 15 times by 2030 and possibly 100 times by 2050.

Bloomberg predicts that the credit prices could move from $3 in 2020 to $120 by 2050

Carbon credits are

Companies meet their climate targets by purchasing credits for their current emissions. Other companies cut their emissions and use credits to compensate for those they cannot avoid.

Credits are traded in units of 1 tonne of CO2 and it is estimated that credits worth 2 billion tonnes of CO2 will be required to get to the 2030 target.

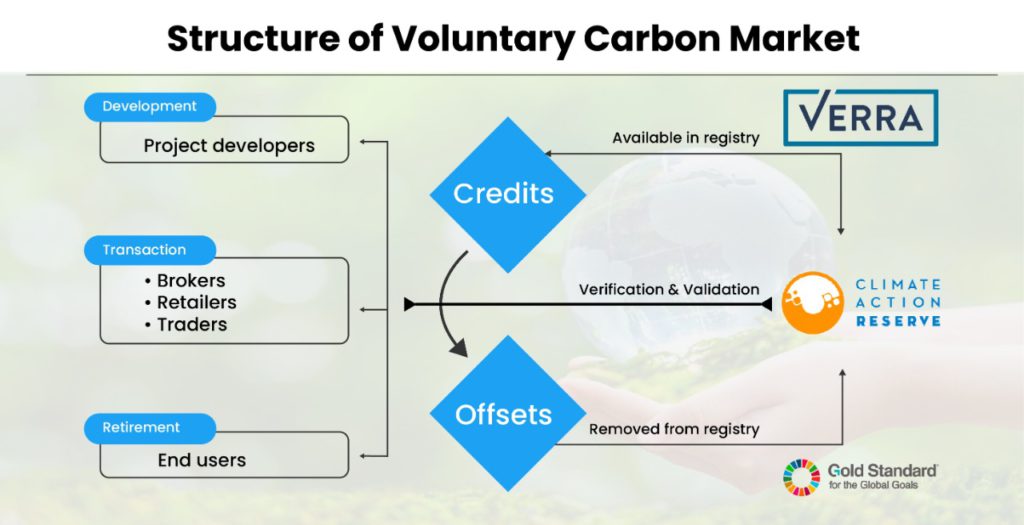

The activities that demonstrate their capacity to remove CO2 from atmosphere or prevent it from being emitted are verified by an independent standard and issued as Carbon credit certificates. The prominent standards include UN- CDM, Verra, American Carbon Registry, Climate Action Reserve and Gold standard.

Each credit that corresponds to one metric tonne of reduced, avoided or removed CO2 or equivalent GHG can be used by the company to compensate for the emission of one tonne of CO2 or equivalent gases. When a credit is used for this purpose, it becomes an offset. This offset needs to be moved to a register for retired credits as it is no longer tradeable.

The deforestation projects known as REDD+ (Reduced Emissions from deforestation and forest degradation) prevent deforestation and wetland destruction. The soil management practices in farming also limit greenhouse gas emissions. Dietary shifts also help to avoid emissions from dairy cows and cattle beef. Afforestation helps in carbon sequestration.

The reduction category normally includes projects that reduce demand for energy efficiency like cookstoves, biogas and development of energy efficient buildings, renewable energy and electric mobility. The removal category includes projects capturing carbon from atmosphere and storing it like in forestry and farming. They can also include technologies like direct air capture or carbon capture and storage.

The voluntary carbon markets provide a platform for organizations to offset their unavoidable or residual emissions by purchasing and retiring these carbon credits. The carbon credits are issued by sellers who have a surplus carbon budget, either because they have avoided emissions or undertaken additional activities for reducing emissions.

Carbon markets have always come under the scrutiny for greenwashing and the purchase of high-quality carbon credit is surely a credible pathway for companies to reach net-zero through reductions and compensation of unavoidable emissions. The credits need to be VALID – Verifiable, Additional, Leakage-free, Irreversible and not Double-counted. These issues need to be addressed and the emission reductions and removals need to align to the country’s NDCs. There must be transparency in the institutional and financial infrastructure of these markets.

The VCM does not have a governance body, the private entities set the criteria for project certification and carbon credits generation. Each standard establishes its own criteria for the projects that it registers. Verra does not accept individuals, American carbon registry is restricted to only US projects and the Plan Vivo focusses on smallholder farmers. Also the nomenclature is different, Gold standard refers to them as Carbon credits, Verra designates them as Verified Carbon Units and Plan Vivo uses the term Certificates. Hence the absence of governance makes it difficult to legally qualify these credits.

Lack of unified standards makes it difficult for participants to verify the quality of a carbon credit. As each standard sets its own qualification criteria for offset projects, the carbon credits cannot be compared.

The offset quality must be transparent and trustworthy. They need to be additional, verifiable, free from leakage and not double-counted. Integrity is very important in the VCM.

Scope 3 emissions are very complex and difficult to capture. Carbon accounting of supply chains needs a robust tool.

There is inaccuracy and unreliability of data captured that results in greenwashing by companies.

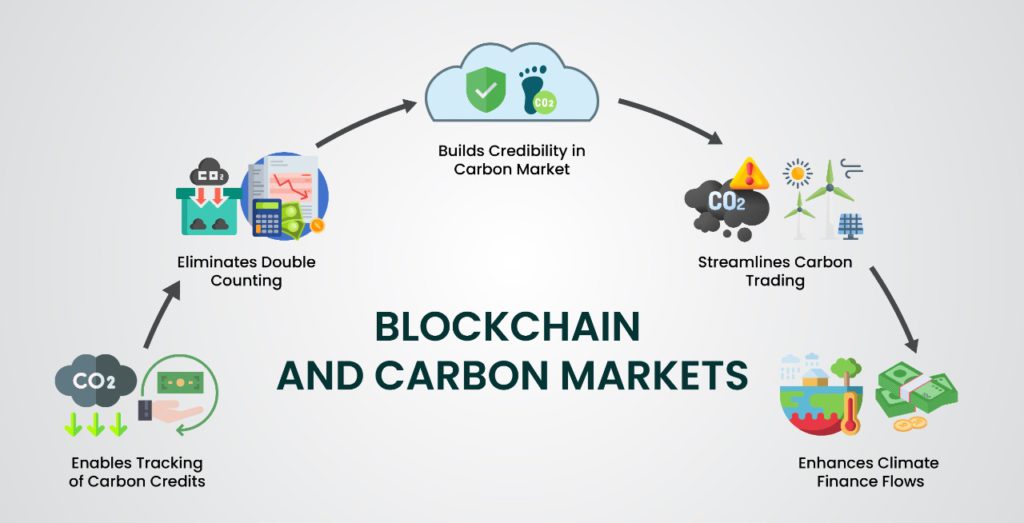

With the scaling of voluntary carbon markets to accelerate climate action, trust and transparency becomes vital to realize the mission of avoiding and reducing greenhouse gas emissions. Blockchain technology solutions drive credibility into this voluntary carbon market. They help in measuring, reporting and verifying the reduced emissions, eliminate double counting, improve the finance flows and help to build trust.

Blockchain is a type of distributed ledger technology that produces a trustworthy transaction record without the need for intermediaries. It is a distributed and decentralized database that stores records in a secure way avoiding manipulation and falsification. The transactions are recorded publicly and permanently based on a consensus mechanism promoting traceability and trust. The smart contracts feature offers the users to automate the processes.

Blockchain helps the carbon markets in the following ways

Blockchain offers a transparent and distributed method of keeping track of transactions along with a detailed audit record across the project lifecycle, thereby preventing greenwashing

The entire journey of the carbon credit from creation to retirement can be tracked, which makes it more reliable and accessible and helps in reducing environmental impacts.

Transparency in tracking of GHGs and reporting emission reductions addresses the double counting issues. It helps in monitoring the progress made in implementing the NDCs under the Paris agreement.

Blockchain democratizes the system of buying and selling credits, ensuring streamlined pathways and the elimination of middlemen. Smart Contracts help in digitizing the negotiation and agreement process.

Blockchain accelerates peer to peer financial transactions and ensures funding is assigned to projects in a transparent manner.

Voluntary Carbon markets spin off innovations in project finance, monitoring and reporting and other methodologies that also influence the regulatory market. In the recent years, governments worldwide have turned to VCM, specifically their standards and registries which serve as a major compliance mechanism themselves.

Today, the 400 million-ton sized voluntary carbon market is hardly sufficient to reduce the global emissions by 420 billion metric tons. There has to be a clear differentiation in the carbon credit supply. Blockchain technology can be a differentiator in the much-needed credible carbon credit market.

Trace Carbon, is TraceX’s one stop solution for carbon management. TraceX’s blockchain platform can bring the necessary transparency and credibility into the voluntary carbon markets.