Contact: +91 99725 24322 |

Menu

Menu

Quick summary: Explore the concept of carbon credits and their role in mitigating climate change. Understand how these credits incentivize emission reduction efforts and contribute to a more sustainable future. Discover their significance in promoting environmental action and cleaner technologies.

Global warming needs to be limited to 1.5˚C to align with the Paris agreement goals. In order to achieve this, the current greenhouse gas emissions need to be cut to half by 2030 and reduce them to net-zero by 2050 and one such innovative strategy emerging is the concept of carbon credits.

Mckinsey estimates that demand for carbon credits could increase by a factor of 15 or more by 2030 and by a factor of up to 100 by 2050, with the market worth upward of $50 billion in 2030.

As the world grapples with the environmental challenges, carbon credits have emerged as a mechanism to incentivize and reward activities that help mitigate carbon dioxide and other greenhouse gas emissions. This blog explores the intricacies of carbon credits, shedding light on what they are, how they work and their role in the broader context of sustainability and climate action. Let us delve into the world of carbon credits and uncover their potential to drive positive change for our planet.

Carbon Credit is essentially a permit received from government or an authority body to emit a certain amount of CO2 for a specific price. Carbon credits are a tradable request that represents a certain amount of carbon dioxide being removed from the atmosphere.

One Carbon Credit = One tonne of CO2

Carbon credits are measurable, verifiable emission reductions from certified climate action projects which reduce, remove or avoid greenhouse gas emissions. They restore forests, reduce dependency on fossil fuels, protect the ecosystems and empower communities. Since these credits are purchased in measurable quantities, the companies which undertake these climate action projects must adhere to several regulations to ensure that credits are put to best use. The projects must adhere to a set of criteria to pass the verification process by third-party agencies and a review by a panel of experts at the leading carbon offset standard like Verra and Gold standards.

The amount of carbon credits allocated to each company is reduced over time. After an organization buys a carbon credit, the credit is permanently retired so that it cannot be reused.

A carbon credit is worth one tonne of CO2e (tCO2e) emissions which is equivalent to 556.2 cubic metre of volume. Carbon credits can be purchased with the intention of contributing to offset projects. Companies set lower emission targets every year so that they can reduce the emissions and not only purchase offsets. Only the residuals are offset.

Carbon Credits are of two types:

This type of carbon credit is backed by the UN and issues a permit for one tonne of carbon emissions. They are issued to UN member states for offsetting projects through the Clean Development Mechanism (CDM), regulated by the Kyoto protocol.

A carbon credit that has a third-party certification standard such as Gold / Verra standards but is not certified by the CDM. It is exchanged over the voluntary carbon market for credits. VER projects are certified but not traded through a central government system.

Carbon credit is a tradeable request that amounts to a certain amount of carbon dioxide being removed from the atmosphere in exchange for an existing carbon footprint that is already there. A carbon credit can only be produced in exchange for a carbon footprint that has already been made.

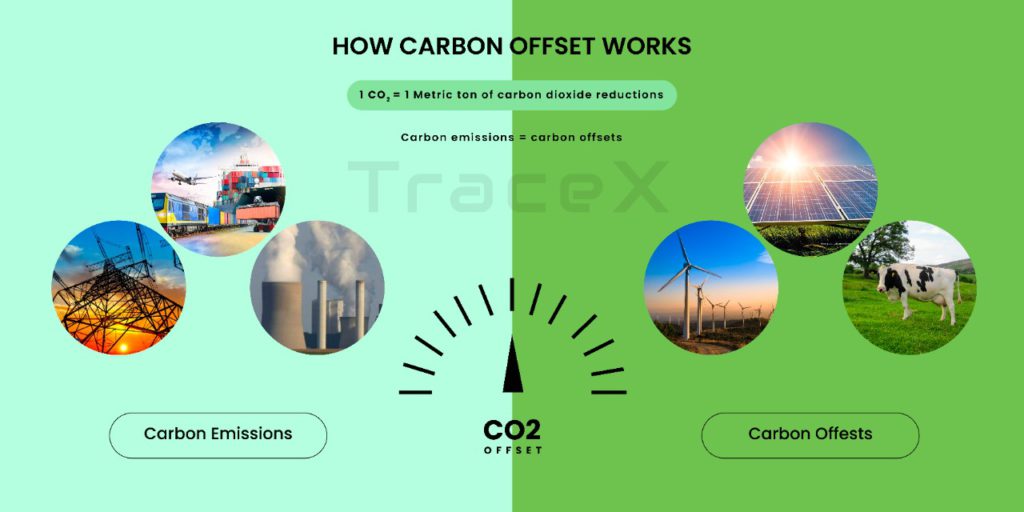

Carbon offset is when a company emitting a high carbon footprint chooses to invest in a project that reduces carbon emissions, instead of reducing their own contribution to global warming on their own. A carbon offset can be purchased in advance to compensate for the anticipated use of carbon emissions. Carbon offsetting is an act of cancelling out the carbon emissions produced in one place with the act of reducing emission in another place.

Both are measured by a tonne of CO2 equivalent.

We just have 10 years to prevent irreversible damage to the planet on account of climate change.

The world’s carbon emissions are increasing at an alarming rate and carbon offsetting is an important mechanism to counter climate change

The benefits of carbon credits are that they contribute to funding for an organization or project that is committed to reducing carbon footprint. They also provide the company producing a high rate of carbon emissions, a greater flexibility to their project. The necessity of altering their production methods can be compensated by purchase of carbon credits.

Carbon credits do not erase the carbon footprint that has already been made. The companies that invest in projects to reduce carbon footprint cannot eliminate the emissions that they have already made. They should not be viewed as a sole strategy to reduce one’s carbon footprint.

Investing in carbon credits is a necessary step in a company’s goals and commitments and is also vital for saving the planet. Businesses should take a holistic view and develop a broad sustainability strategy because carbon credits are not a quick fix to solve the real-world problem and they should never prioritize emission reductions.

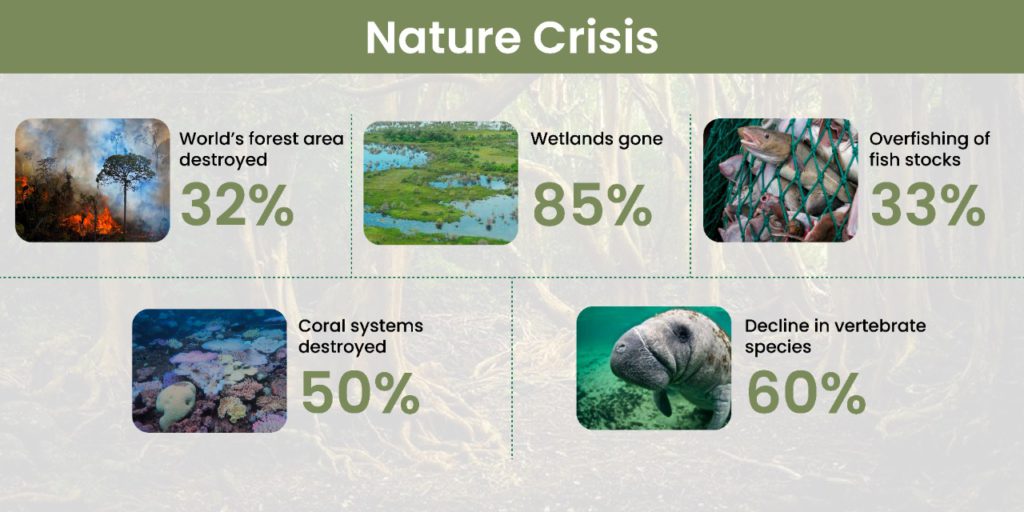

According to the World Economic Forum, $44 trillion of economic value generation is highly dependent on nature and its degradation is happening at a rapid pace.

Carbon Projects reduce or remove the greenhouse gas emissions in these 3 ways :

Nature based solutions are designed to protect, restore and manage nature while mitigating climate change and facilitating a green future. These solutions include land restoration, forest protection, reforestation, agriculture and sustainable land management. They are a critical path to net-zero transition.

Nature based solutions are becoming an integral part of climate action, with carbon markets providing an indication of demand.

Do you know that credits are generally traded in units of 1 tonne of CO2, and it’s estimated that credits worth 2 billion tonnes of CO2 will be needed to get to the 2030 target?

Carbon prices vary depending on the projects. They can go from roughly $10 to hundreds based on the offsetting project and the market that its bought from.

The price variation could be due to

Global prices of carbon credits are climbing upwards by 60% more in 2021 ($4.0) than in 2020 ($2.5).

Carbon Credit Market

According to Coherent market Insights, the global carbon credit market was valued at US$ 211.5 billion in 2019 and is expected to reach US$ 2,407.8 Billion by 2027 at a CAGR of 30.7% between 2020 and 2027.

The global Carbon Credit Trading market size was valued at USD 2000.0 million in 2021 and is expected to expand at a CAGR of 29.88% during the forecast period, reaching USD 9600.0 million by 2027.

Global Voluntary Carbon Offsets market size is projected to reach US$ 700.5 million by 2027, from US$ 305.8 million in 2020, at a CAGR of 11.7% during 2021-2027.The real value of the voluntary carbon market is now around $2 billion, with rising price trends of about 170 types of carbon credits as per a recent Ecosystem Marketplace (EM) report.

The Compliance offsets are regulated by the government and the carbon reduction schemes like the CDM. The Voluntary offsets are not regulated by UN or the government and are only certified by third-party auditors.

There are 17 emission trading programs in the world operating in 35 countries. Trading programs are regional efforts that normally use a cap-and-trade system which allows certain amount of carbon credits to be bought and that decreases yearly to lower the emissions. Trading can happen between entities if one uses less and another needs to utilize more.

The EU Emissions Trading system (EU ETS) is the world’s largest carbon market. California Cap and Trade, Chinese National Emission Trading scheme (ETS) are a few more.

Carbon credits are not universally equivalent. There are instants when these credits do not fulfil their stated purposes. They fall short of meeting the standards required for participation in the global voluntary carbon market. This forms the foundation of an emerging initiative advocating for removal of subpar carbon credits from the market and ensure that the industry genuinely contributes to climate action.

Companies must discern carbon credits originating from robust, high integrity carbon offset programs to effectively leverage their offsetting endeavours for optimal impact. A crucial gauge of excellence within the global voluntary carbon market rests upon project certification by registering bodies. Multiple certifying entities allocate carbon credits to projects, each adhering to standards mandating stringent criteria encompassing monitoring, substantiating evidence, project permanence and the project’s unique nature resulting from carbon credit funding.

Discover high quality credits for the carbon market

Remember

Trace Carbon the carbon management platform with DMRV from TraceX represents a significant leap in the field of carbon credit generation. Through its robust data collection, automated reporting and verification processes, the platform ensures the accuracy and credibility of emission reduction efforts. By providing a quantifiable and verifiable approach to carbon credit generation, this innovative solution empowers organizations to take meaningful steps towards a more sustainable future while contributing to global climate action.

Carbon credits serve as vital tools in the fight against climate change, functioning as tangible proof of emission reduction efforts. These credits, obtained through verified and approved projects, enable organizations to balance their emissions by investing in activities that offset their carbon output. By participating in the carbon credit market, businesses can contribute to sustainable initiatives, promote cleaner technologies and support projects that drive positive environmental and social impacts.